(Re)Charging ahead: how to keep electric vehicles topped up

By 2030, there will be over 100 million plug-in electric vehicles (EV) on the road globally.[1] More than half of these are sold in China, but the rest of the world is catching up rapidly; over the next five years, sales will double in the United States and quadruple in the EU-27 plus the UK.[2] EV adoption will become widespread as prices and charge times decrease, while choice and ranges increase.

The technology is already many miles ahead of where it was ten years ago. When the all-electric Nissan Leaf was introduced in 2010, it had a maximum range of around 70 miles. Compare that to RIVIAN, the fledgling US-based EV manufacturer, and the darling of recent high profile investment funding rounds including big hitters like Amazon, Ford and Cox Automotive, and in which JIMCO (the Jameel Investment Management Company) was a critical early investor. RIVIAN is introducing a pick-up and SUV in 2021 that are capable of traveling more than 400 miles per charge – opening up a new frontier for EV, quite literally with their focus on all-road four wheel drive vehicles. McKinsey estimates that EVs could account for 30% of passenger vehicle sales across China, the EU-27, and the United States by 2030[3]. Toyota alone, one of the global pioneers in electric vehicles, aims to sell over 5.5 million per year by 2030[4]. This brings the prospects for cleaner vehicles and cleaner air much closer – provided we don’t run out of charge en-route.

Finding the power

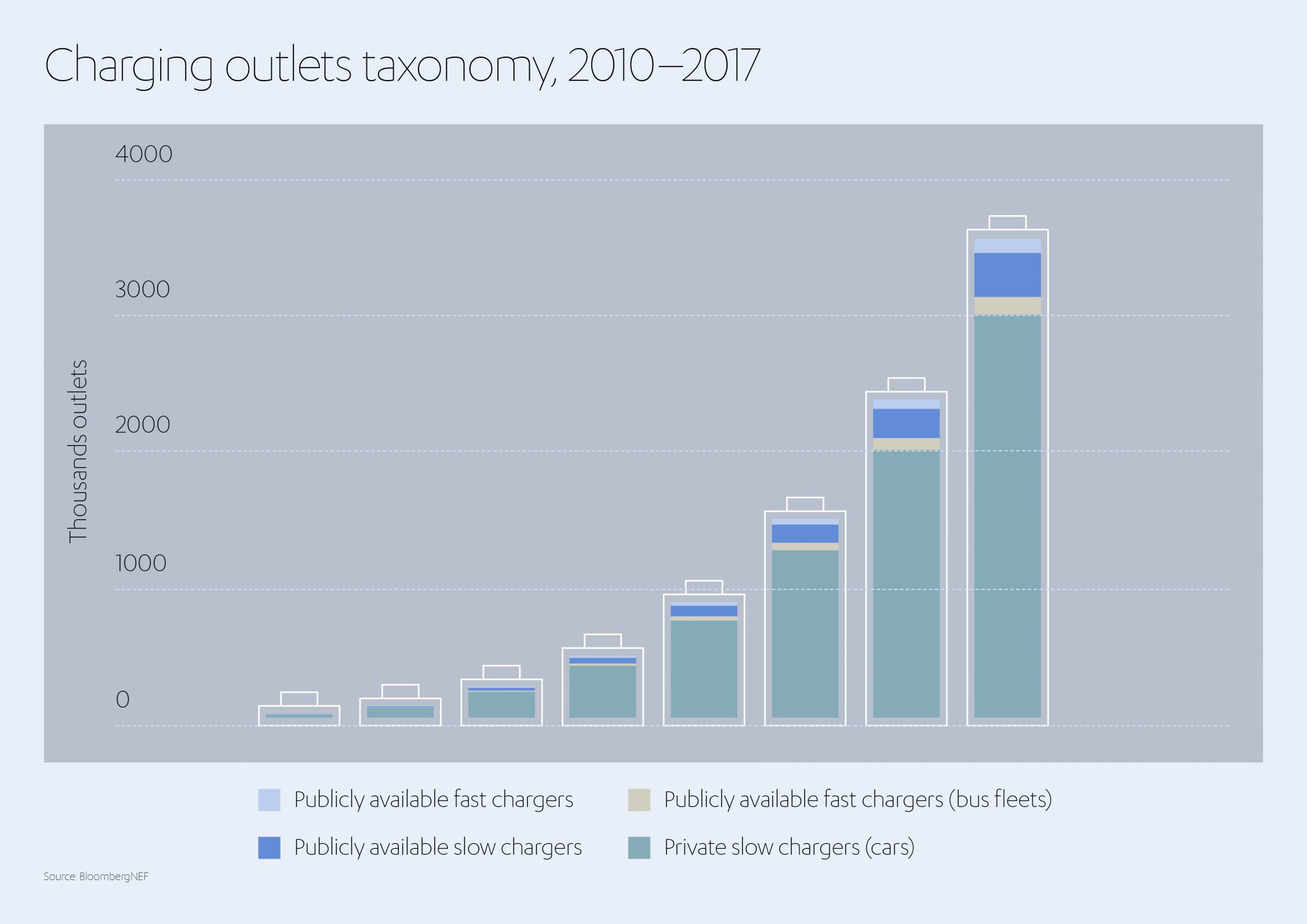

Global charging infrastructure has doubled in the past three years. Again, China leads the way with over half the chargers[5], followed by Europe, and the US as a distant third[6]. But there is a long way to go. McKinsey estimates that 22–27 million charge-points will be needed in China, the EU-27 plus the UK, and the United States, by 2025. By 2030, that number will rise to 55 million, raising power demand from 180 TWh to at least 525 TWh per year[7].

The market is currently dominated by home chargers and slower public chargers, often in sub-optimal locations, with a customer experience that leaves much to be desired. Even so-called rapid chargers take around 45 minutes, far-longer than filling up with gasoline (and an eternity if traveling with children). To facilitate EV adoption, the world needs more chargers, more supporting infrastructure, and more power.

It will take scalable, consumer-focused business models, widespread collaboration, massive investment, and government backing. According to McKinsey, an estimated US$ 110 billion to US$ 180 billion must be invested from 2020 to 2030 to satisfy global demand for EV charging stations, both in public spaces and within homes[8].

So, what are the technologies and business models that can help us meet these requirements? And what bumps can we expect in the road ahead?

Who are the influencers?

Just about everyone. The EV charging industry encompasses numerous operators across the private and public sectors, including:

- Charge point operators (CPOs)

- Electrical-equipment providers

- Developers and property owners

- Venture capital and hedge funds

- Urban planners, regulators, and governments

- Electricity suppliers and grid operators

What are the charging methods?

Alternating-current (AC) chargers are the typical choice for residential, street, workplace, and destination charging. Public AC level 2 chargers can supply up to 19 kWh and take between 2–8 hours to recharge an empty battery. This is usually fine given how long vehicles normally park at these locations and because EV batteries are rarely fully depleted on most journeys. AC chargers run on the same current as standard electrical components in buildings, making them easier and cheaper to install.

Direct-current fast chargers (DCFC) can provide up to 350 kWh and charge passenger cars in under an hour. They’re essential for larger commercial vehicles but require more expensive electronics and more electricity, which means they must be placed in high-demand locations to justify consumer use.

AC chargers will remain the dominant form of chargers for the foreseeable future but expect to see more DC chargers as commercial fleets electrify, and EV drivers become more comfortable with longer journeys.

EVs unplugged?

Most chargers work by plugging in your vehicle. But it may not always be essential. Wireless charging uses magnetic-resonance induction to enable topping-up on the go. If the technology takes off, it will likely be led by commercial vehicles. For example, charging electric buses at bus stops or taxis queuing at the airport. It is even theoretically possible to create highways with constant charge throughout, although this is almost certainly prohibitively expensive[9].

Where are the main charging locations?

Residential: Charging at home is the most popular option in the EU-27, UK, and the United States, due to the low cost of residential electricity and the high rate of homeownership among affluent early adopters of EVs (charge points can cost anywhere from US$ 500 to US$ 1,000)[10]. Residential charging also includes charging in shared amenities, such as apartment complexes. This form of charging is more prevalent in countries where there is a lower ratio of single-family homes, such as China and the UK.[11] Home charging is likely to remain the dominant segment and benefits from low regulation and low investment costs, plus a large customer base for charge point operators to achieve scale.

Workplace: Charging while parked at work is usually done at similar speeds to home charging. Workplace charging helps businesses signal their green credentials and attract EV driving employees, particularly if they are located in areas with fewer charge points. However, the increase in remote working might slow workplace adoption.[12].

Street: Includes roads in residential areas, motorways, and even dedicated electric highways for EVs. Charging on route typically requires fast chargers.

Fleet: Charging taxis or commercial delivery vehicles at a central hub, with rapid charging essential for larger vehicles and fast turnarounds. Probably the best option for vehicles with a regular route, such as buses, etc.

Destination: Charging at high-footfall ‘destination’ areas such as supermarkets, leisure centers, and gyms. Longer dwell times allow chargers with similar speeds to home charging.

What are the business models?

Some operators may specialize in one charging segment, such as rapid charging. Others may build more extensive portfolios to diversify risk and create multiple revenue generation opportunities. There is even the potential to sell electricity back to the grid from stationery EVs or find margins by facilitating charging during low demand periods (i.e. ‘load shifting’). Energy suppliers, which have a vested interest in increasing energy demand, can target their large base of existing customers with special EV packages and tariffs. EV manufacturers can provide charging equipment at a discount or free to incentivize EV sales.

EV charging is a fragmented, emerging market, so not everyone will fit neatly into these categories. Either way, any business model must be scalable and ideally generate multiple revenue streams.

“The more charge points an operator develops, the greater the potential to deliver multiple services, generate alternative revenue streams and create a ‘sticky customer’ value proposition. Network scale also unlocks efficiencies of scale from maintenance through to the cost of capital. Moreover, there is an argument that in the long term, those operators who have a national network are more likely to thrive,” states PwC in a report into EV charging[13].

Bumps in the road

Rolling out and managing EV charging infrastructure and services is a complex job involving multiple stakeholders. It is vital to plan early and think long term to keep costs down. Some of the primary considerations include:

Where to place chargers

Optimal charger placement will vary for different operators, depending on which segment(s) they focus on. Of course, high traffic routes and popular destinations are obvious choices. Mobility data, including GIS data and mobile phone data, with modeling and AI, can help inform the placement of charge points[14].

AC chargers range from US$ 400 for home charge points to US$ 2,400 for public AC level 2 charge points. DCFC charge points cost more than US$ 30,000 for the lower-end, 50–150 kW. Hardware, power distribution, and software services are even more expensive. Businesses and property developers need to factor in power supply when planning buildings and coordinate with urban planners. Indeed, The International Code Council states that all newly constructed homes should be EV-ready, and US local governments have already accepted the guidelines.[15]. Similarly, the EU-27 plus the UK will require members to specify a minimum number of charging points for all nonresidential buildings with more than 20 parking spaces by January 1, 2025[16].

Installation aside, electricity itself is often the highest hidden cost. What begins as a nominal fee for one employee could quickly rise as EV adoption increases.

This raises the next question…

How do we balance the grid?

All that power has to come from somewhere. That means ramping up power generation—ideally from renewable sources—and investing in the infrastructure to deliver it. However, it’s doubtful that energy supply alone will scale to meet all EV demand without interruption. Energy management will be essential.

Project Director EV National Grid

“In the UK, we see launches of great innovative electric vehicles. We see innovative charging, and we also see great technology platforms, which will help accelerate the market. The things that concern me, though, is the underlying infrastructure that supports that. So, some strategic investment in the underlying grid infrastructure will help accelerate this market,” says Graeme Cooper, Project Director for electric vehicles at National Grid[17] in the UK.

Smart pricing, charging more for electricity at peak times or instant charging, will ease pressure on the grid. EVs can even contribute electricity to the grid themselves via Vehicle to Grid (V2G) services. As the numbers of EVs rise, they will represent a significant combined battery capacity EVs could transfer electricity in exchange for cash or preferential charging rates. This holds vast potential, particularly to help smooth out the variable power output of renewables. Automation will be required to provide a fair service that considers different charge point operators and energy suppliers, fluctuating electricity costs and availability, weather data, variable pricing, and so on.

Putting consumers in the driving seat

The environmental concerns of individuals are not enough to facilitate widespread EV adoption. That’s why companies like RIVIAN and Tesla create vehicles that consumers want to drive, rather than just think they should. The same logic applies to EV charging, but charge point operators will need to consider a number of key issues to create a service that people will actually want to use:

- Overcome range and experience anxiety: There needs to be enough chargers in the right places at the right speeds to make charging painless. Knowing consumer behavior will be vital to selecting the optimal locations and enhancing the customer experience.

- Price-sensitivity: The right business models will deliver attractively priced services, including incentives and bundling, with appropriate premiums for fast charging, e.g., when on route to a destination.

- Control: Consumers should feel like they have the same freedom as traditional vehicles, be able to wait for lower energy rates, and decide how much electricity they share with the grid.

- Ease-of-use: Intuitive software and apps will give EV owners the ability to monitor energy use and spend. They should be able to set basic parameters (e.g., always charge at the lowest cost, or charge within x time).

The scale of the task means that multiple stakeholders will have to coordinate their activities to scope out infrastructure, share costs, and keep them as low as possible. Charge point operators must liaise with businesses, property developers, architects, civil engineers, electrical engineers, and urban planners to align installation with demand and grid expansion.

For its Toyota Prius Plug-In in the UK, for example, Toyota partnered with BP Chargemaster, part of energy giant BP, to develop a 7kW home charger that can charge the vehicle’s battery from flat to full in 2.4 hours.[18]

Another way to increase EV uptake while relieving the pressure on infrastructure is to make charging equipment inter-operable between different OEMs, provided all parties agree on how to apportion costs. Expect to see more brands like Ionity, a joint venture between BMW Group, Ford Motor Company, Hyundai Motor Group, Mercedes Benz AG, and Volkswagen Group with Audi and Porsche, to create a charging network across Europe with 400 charging stations along major European highways and an average of six charging points per station.

Governments can change gears

Where the market fails, governments can step in with a judicious balance of carrot and stick. The European Union recently announced a goal of 1 million public chargers by 2025[19]. The UK is already investing US$ 50 million in transforming its network of electric charge points, with wireless charging and ‘pop-up’ pavement technologies both winning new funding. Although even that pales in significance to California’s proposed US$ 1 billion[20].

Emissions targets make EVs all but essential in many countries. In the EU, EVs and hybrid-vehicles will need to account for at least 22% of vehicles on the road by 2030[21]. Some locations are going even further. Amsterdam will require zero-emissions from commercial vehicles in the city center by 2025, with net zero-emissions for all traffic throughout the city planned for 2030[22].

Financial incentives, such as price subsidy schemes and vehicle tax exemptions, will give businesses and consumers a welcome nudge. And priority lanes for EVs won’t hurt, either.

If that doesn’t work, outright bans will.

In 2016, Athens, Madrid, Mexico City, and Paris announced their intention to outlaw diesel cars and vans from the streets within a decade. Paris has already got rid of older diesel vehicles. Denmark and the UK are banning sales of all gasoline-fueled vehicles after 2030, and California has set a similar target for 2035. China and India are intending to follow Norway’s example by introducing legislation to ban all fossil-fueled engines.

Build it and they will come?

Government help isn’t always necessary. In 2015, Kansas City Power and Light Company invested US$ 20 million to install 1,000 charge points, despite the fact there were only 1,600 plug-in EVs in the entire state at the time. When the infrastructure was available, customers flocked in, and adoption grew by 78% between 2016 and 2017. It also had the welcome benefit of increasing demand for the utility provider’s nuclear and wind power, thus driving down the per-unit cost[23].

Collaboration is critical

The EV revolution is accelerating and, as an active investor in the infrastructure of life, including the future of sustainable mobility solutions, Abdul Latif Jameel is proud to be part of the journey. However, to realize the promise of global green transport, EVs must become the default choice – not just the aspirational one. Manufacturers must keep innovating; Governments must provide the regulatory push; and all stakeholders – including investors, charge point operators, energy providers, businesses and public authorities – must keep working together to provide the power, the connectivity and the service at the right price.

Whilst the exact route remains a little unclear, we firmly believe we are heading in the right direction.

[1] Charging Infrastructure for Electric Vehicles 2020–2030, IDTechEx

[2] Driving into 2025: The Future of Electric Vehicles, J.P. Morgan, October 10, 2018

[3] How charging in buildings can power up the electric-vehicle industry, McKinsey, January 2021

[4] Toyota and battery electric vehicles (toyota-europe.com)

[5] https://www.bloomberg.com/news/features/2019-10-15/china-electric-car-chargers-fleet-outpaces-u-s-ev-stations?sref=JuSsFiEr

[6] https://www.bloomberg.com/news/features/2020-06-01/electric-car-chargers-will-determine-america-s-green-future?sref=NzfUqEPA

[7] How charging in buildings can power up the electric-vehicle industry, McKinsey, January 2021

[8] How charging in buildings can power up the electric-vehicle industry, McKinsey, January 2021

[9] https://www.economist.com/science-and-technology/2020/05/14/wireless-charging-of-electric-cars-looks-increasingly-promising

[10] How charging in buildings can power up the electric-vehicle industry, McKinsey, January 2021

[11] How charging in buildings can power up the electric-vehicle industry, McKinsey, January 2021

[12] Powering ahead! Making sense of business models in electric vehicle charging, PwC, October 201

[13] Powering-ahead-ev-charging-infrastructure.pdf (pwc.co.uk)

[14] https://core.ac.uk/download/pdf/148676205.pdf

[15] All new homes should be EV-ready, says international code council, January 16, thedriven.io

[16] New buildings in Europe required to have EV charging points, Fleet Europe, April 20, 2018

[17] Powering ahead! Making sense of business models in electric vehicle charging, PwC, October 2018

[18] Chargemaster for Plug-in | Latest News & Events | Toyota UK

[19] https://www.bloomberg.com/news/articles/2020-06-23/electric-car-charging-stations-are-finally-about-to-take-off?sref=JuSsFiEr

[20] https://www.bbc.co.uk/news/business-48913028

[21] https://www2.deloitte.com/content/dam/Deloitte/uk/Documents/manufacturing/deloitte-uk-battery-electric-vehicles.pdf

[22] How charging in buildings can power up the electric-vehicle industry, McKinsey, January 2021