Electric dreams?

Extreme global weather events over the past 12 months have been a stark reminder of the climate crisis facing our planet, and the urgent need to transition to a net zero economy.

Photo Credit: © United Nations

The challenge was underlined in March 2023, when the UN secretary general Antonio Guterres warned: “the rate of temperature rise in the last half century is the highest in 2,000 years. Concentrations of carbon dioxide are at their highest in at least 2 million years. The climate time-bomb is ticking.” [1]

Guterres was responding to the sixth synthesis report from the Intergovernmental Panel on Climate Change (IPCC), which he described as a “survival guide for humanity”.

The report found that five years after the IPCC had highlighted the unprecedented scale of the challenge required to manage global temperatures, “that challenge has become even greater due to a continued increase in greenhouse gas emissions”. The IPCC highlights transport – alongside the food sector, industry, buildings, and land-use – as one of the key areas that can make a significant contribution to reducing greenhouse gas emissions.

But, is our future electric?

There are various potential alternatives to traditional, emissions-heavy transport technology that relies on gasoline or diesel-powered internal combustion engines (ICEs), including hydrogen-powered vehicles and sustainable biofuels. Both these technologies pale, however, in comparison to the recent growth in both models available and consumer adoption of electric vehicle (EV) technology. This includes pure battery electric vehicles (BEVs) as well as hybrid electric vehicles (HEV) and their ‘sister’ plug-in hybrid vehicles (PHEV), which combine electric power with an ICE.

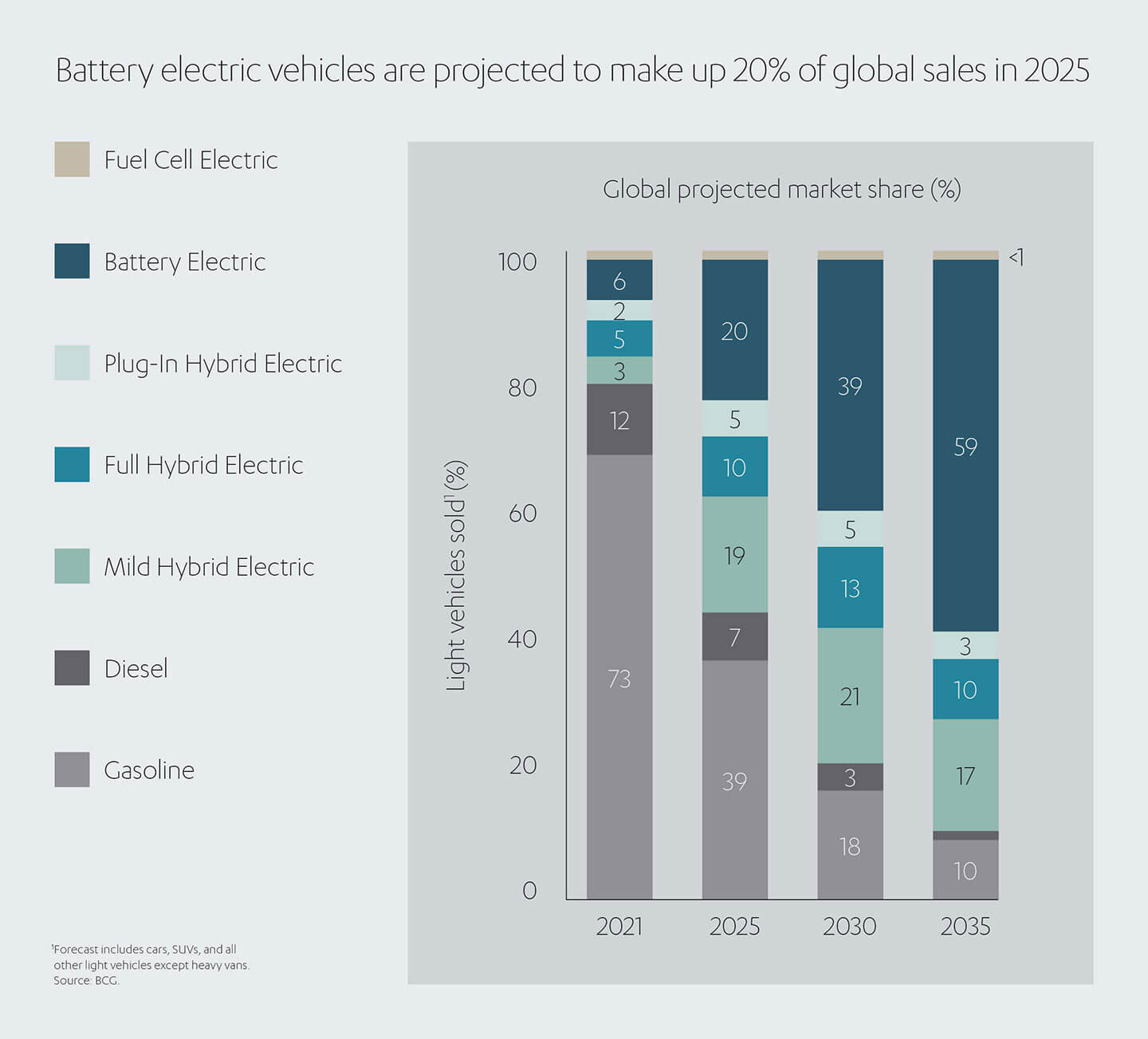

If you look at the stats alone, the growth in EVs is undeniably impressive. A June 2022, report from BCG consultancy said the previous year had been “phenomenal for electric vehicles, including hybrids”. These accounted for a fifth of all light-vehicle production in 2021, a 12% increase on the previous year. Meanwhile, the proportion of gasoline and diesel cars fell by nine percentage points.[2]

Stricter emissions targets from regulators and new EV options from carmakers were together “turbocharging the global market for EVs”, said the BCG report. The European Union (EU) has banned sales of new ICE cars from 2025, while a number of US states have agreed to bring in zero-emission quotas for new passenger cars. In the UAE, the government is aiming for 50% of the cars on the road to be electric by 2050[3], while Saudi Arabia is aiming for 30% of Riyadh’s cars to be electric by 2030.

Amid such incentives, major automotive manufacturing companies are, unsurprisingly, only too eager to capitalize on this booming EV market, each with their own ambitious electrification strategies. America’s General Motors plans to go all-electric by 2035 and Ford Motor Company has set the same goal for its European arm, Ford of Europe, by 2030. Across the globe, experts expect that lower costs, improving technology and wider choices will all contribute to EVs becoming an increasingly consumer-friendly option over the next few years.

Given these developments, analysts are making optimistic predictions about future EV adoption. BCG experts expect BEVs to be the most popular type of light vehicle sold globally in 2028—three years earlier than it forecast in an earlier, 2021 report. And it predicts global sales of these vehicles to far outweigh those of ICEs by the turn of the decade.

Similarly, McKinsey expects worldwide demand for EVs to grow six times larger between 2021 and 2030, with annual unit sales rising from 6.5 million to about 40 million. The consultants believe that public acceptance of EVs – once uncertain – has reached a tipping point and will continue to grow as consumers seek more economical, environmentally-friendly transport options.[4]

The momentum behind the growth in EVs seems, on face value at least, somewhat unstoppable. But is the hype justified, or are there bumps ahead along the highway to an EV future?

From Motors to Mobility

President & CEO, Toyota Motor Corporation. Photo Credit: © Toyota

Society’s changing attitudes towards EVs are indicated by Koji Sato, the president and CEO of Toyota Motor Corporation, Jameel Motors’ long-standing partner for over 65 years. “We aim to transform our company into a mobility company,” said Sato in April 2023.[5] This will include a focus on achieving carbon neutrality – which Toyota plans to reach across its vehicles’ life cycles by 2050. It intends to do this through growing sales of hybrid vehicles, as well as investing in next-generation BEVs and looking ahead to what it calls “the hydrogen society”.

The vision also involves a broader focus on expanding the value of mobility, said Sato, explaining that “the cars of the future will become more connected to society as they become more electrified, intelligent, and diversified”.

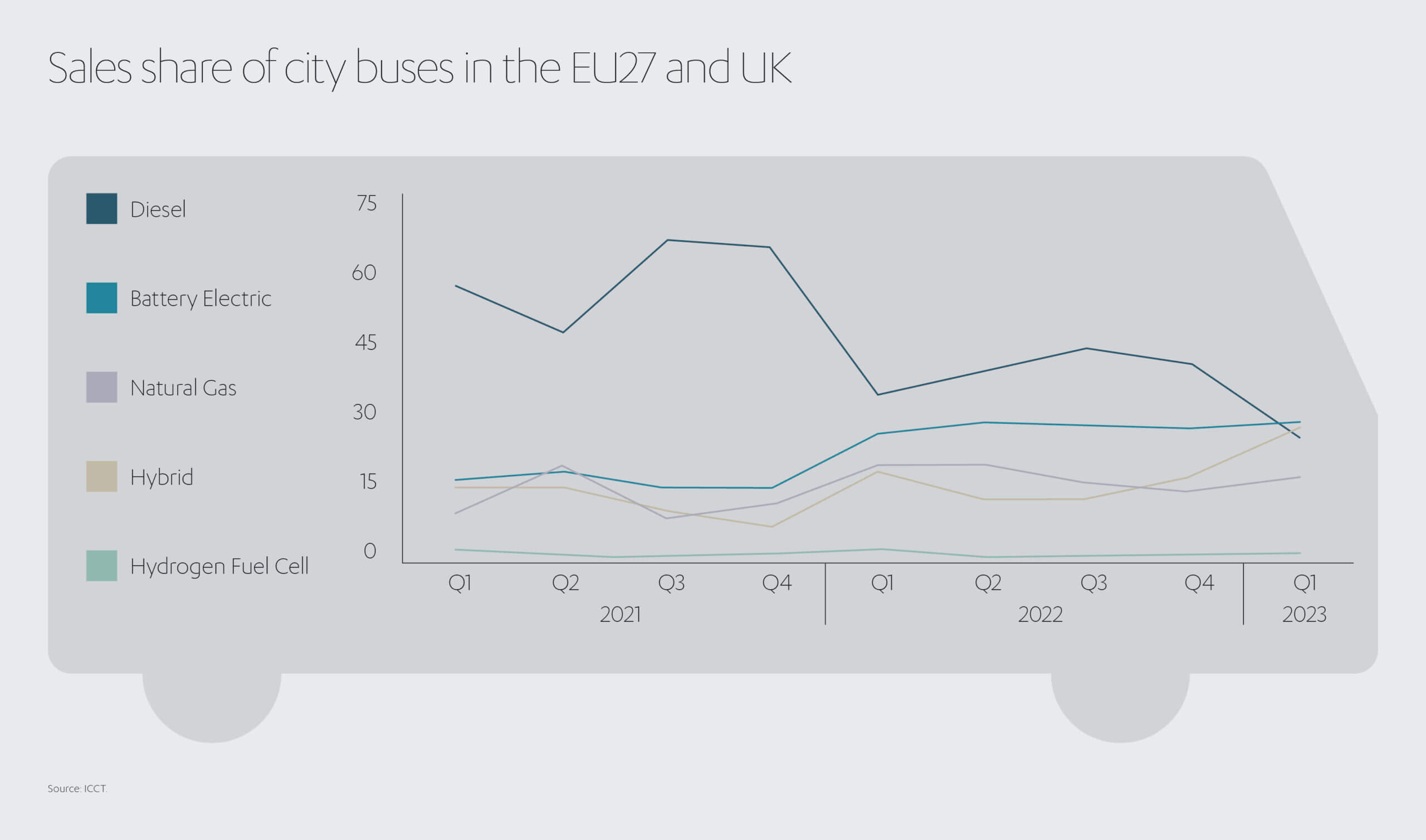

This ambitious outlook underlines our changing attitudes to mobility in general and particularly electric mobility is no longer just about cars. A McKinsey report last year predicted that by 2035, the majority of new trucks in the US, EU and China will be electric[6]. And the electrification of public transport such as buses is already rapidly progressing. According to the International Council on Clean Transportation (ICCT), a non-profit organization, sales of both hybrid and battery electric buses in Europe overtook the proportion of those running on diesel for the first time this year[7], a trend attributed to market demand.

In addition, a 2023 report from the International Energy Agency (IEA) points out that two or three-wheeled vehicles are the most electrified market segment today, outnumbering cars in emerging markets and developing economies like India. More than half of three-wheeler registrations in the country in 2022 were electric.

Given their affordability, the electrification of transport modes like this “is important to support sustainable development”, the IEA says.

Aside from modes of transport, Sato’s comments also recognize that developments in electric vehicles will go hand-in-hand with those in related technologies such as automation, data, communications and artificial intelligence. There is exciting potential for these to come together into a holistic vision of future mobility.

This doesn’t mean the end of cars – which, especially for now, are a crucial element of electric mobility. But the concept also includes other modes of transport, and the idea of connecting all of these intelligently to wider systems. It’s in this spirit that Sato argued that “mobility lies beyond the future of the car”. And that Toyota’s vision is to “lead the future mobility society, enriching lives around the world with the safest and most responsible ways of moving people”.

Bumps in the road?

The are clearly major issues to consider before we reach this promised land, however. While on the outside, EVs look similar to their ICE counterparts, the way they are made, the technology they utilize, and the infrastructure they require are significantly different. Differences that are likely to create some challenges on the journey to an EV future.

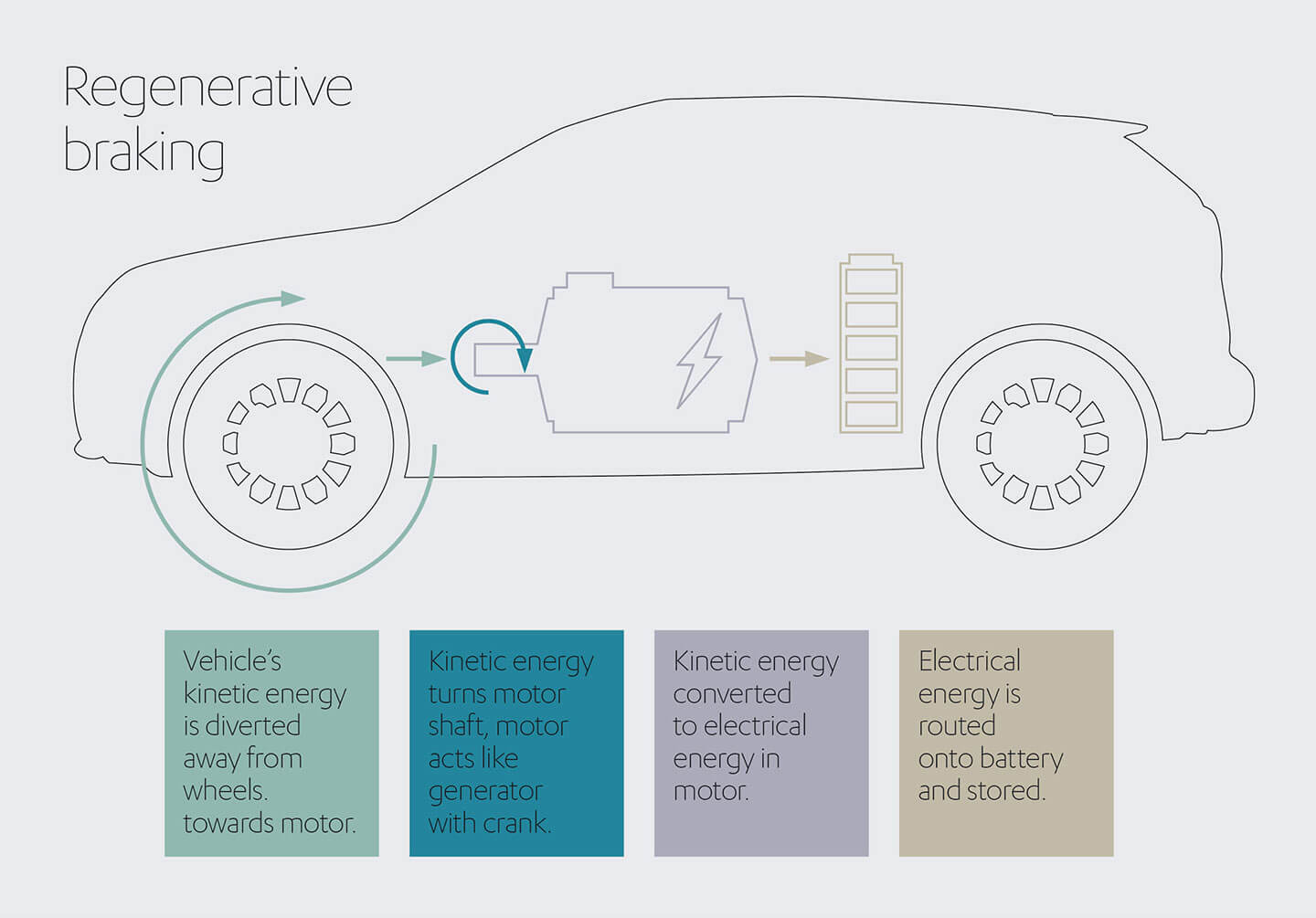

In simple terms, an EV runs via an electric battery, which powers an electric motor to turn the wheels. With a pure BEV, the battery will need to be periodically recharged by plugging the vehicle to a charger. In addition, EVs can also capture the kinetic energy generated when stopping and convert this into electricity, through a process known as regenerative braking[8].

The picture is more complex with hybrid vehicles, of which there are two main types. A plug-in hybrid electric vehicle (PHEV) – like Toyota’s groundbreaking Prius – has a rechargeable electric battery, but also includes an ICE engine which the vehicle can switch to if it runs out of charge. In contrast, a hybrid-electric vehicle (HEV) runs mainly using an ICE, but also has an electric battery powered using regenerative braking.

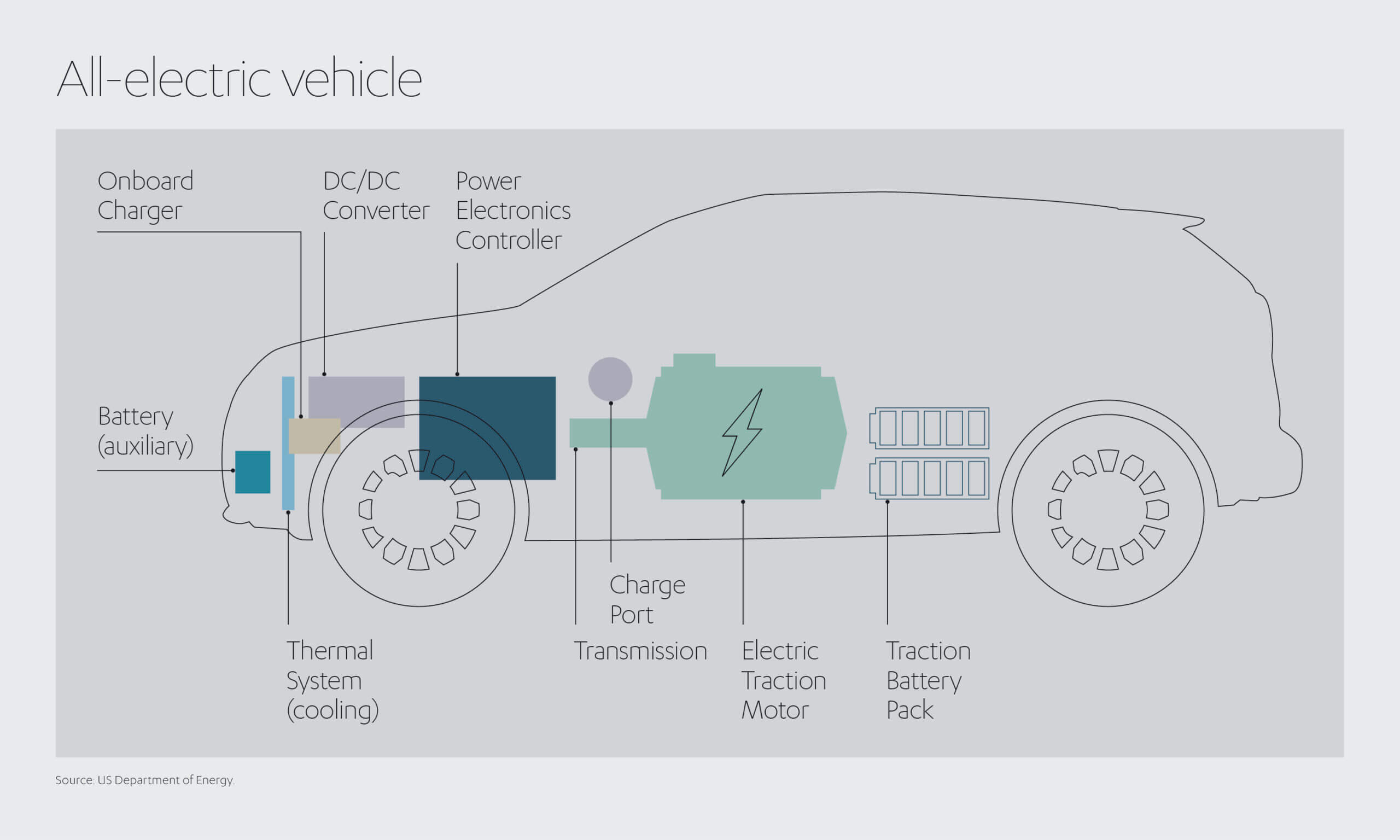

The insides of each these vehicle types will look different. Alongside a battery and electric motor, an all-electric BEV will also have an onboard charger that converts the alternating current (AC) from mains electricity into a direct current (DC) that charges/powers the battery. Other parts include a thermal cooling system to maintain the right operating temperature of the components, and a DC/DC converter to convert DC power into a lower voltage where required.

Plug-in hybrids include these components alongside the typical parts of a traditional vehicle such as an ICE, fuel tank and exhaust system. Meanwhile, hybrid-electrics include these traditional ICE vehicle components alongside some EV parts – but not those concerned with external charging (such as the onboard charger, that converts AC to DC).

Whether viewed from the perspective of drivers or wider society, EVs, ICE vehicles and hybrids all come with different advantages, as well as potential drawbacks. Perhaps most importantly, a BEV produces zero exhaust emissions, offering significant benefits for net zero ambitions. However, the US Department of Energy notes that BEVs are typically more expensive than similar conventional and hybrid vehicles, as well as generally having a shorter range.[9] At the moment, both types of hybrid vehicles also tend to be more expensive than conventional cars. But both also offer lower emissions, less fuel usage and can offer a convenient balance for drivers who aren’t ready to switch to a pure EV.

Challenges remain

EVs may herald a cleaner, greener future for mobility, but for now that destination remains some way off. Not least because all but a handful of countries currently rely on fossil fuels for well over half of their electricity generation[10]. So in the short term, more EVs on our roads could potentially lead to an increase in CO2 emissions, rather than a decrease, until renewable energy sources of power generation are scaled up sufficiently.

Many consumers are still hesitant about EVs due to the purchase cost. The average cost of an electric car in the UK is over US$ 60,000[11], while in the US an electric vehicle is around US$ 12,000 more than an ICE equivalent on average[12]. But prices are falling. According to BCG’s analysis, in China and many European countries the total cost of EV ownership over five years is the same for a midsize car whether it is a BEV or ICE model, (the calculation accounts for purchase price, maintenance costs, and miles driven, as well as fuel and electricity costs). And for much of the world, EVs are heading toward purchasing-price parity with traditional ICE vehicles by 2030.[13]

Falling ownership costs are also helping to drive consumer demand, due to factors including lower battery prices and greater economies of scale. BCG says that manufacturers can increasingly market EVs using characteristics such as their towing capacity and low maintenance – as well as additional benefits such as being able to use an EV battery as a backup generator for homes.[14]

Despite these encouraging signs, there are other issues that could slow the transition to EVs. One of these is meeting the rapidly growing demand for batteries – and the rare earth minerals required for their construction. McKinsey forecasts that demand for lithium-ion batteries – the type used for most EVs – is expected to grow by about 30% a year globally by 2030, with about 90% of the increase down to mobility applications such as EVs.[15]

This trend is having some concerning knock-on effects, such as putting pressure on the supply chains for the raw materials used to make batteries. According to the IEA, last year about 60% of lithium demand was for EV batteries, together with 30% of cobalt and 10% of nickel demand. In contrast, the respective proportions five years previously were about 15%, 10% and 2%.

This situation has already contributed to shortages of lithium. In June 2023, Reuters reported on producers’ concerns that delays in mine permitting, staffing shortages and inflation could hold them back from being able to supply enough of this metal to meet global electrification timelines[16]. And the IEA warns that mining and processing of other critical minerals will also need to increase rapidly to support the switch to EVs and other clean energy technologies.[17]

The growth in EV adoption also raises concerns about the impact on the power grid and the challenges that utilities must overcome to ensure a reliable and efficient energy supply. Even more so in emerging markets where existing power distribution systems are often sub-optimal. For example, it has been estimated that if a family replaced their two ICE vehicles with EVs, it would increase their daily household energy usage by 74%.

Meeting that increase in power demand alone is not necessarily the problem. On paper, many countries have more than enough electrical energy to meet the total future demand for EVs. The issue is, that energy isn’t always ready to be drawn when required. In a world where grid imbalances are normal due to fluctuating electricity usage, the last thing a grid operator needs are millions more EV owners charging their cars—and pulling from the grid—all at the same time.

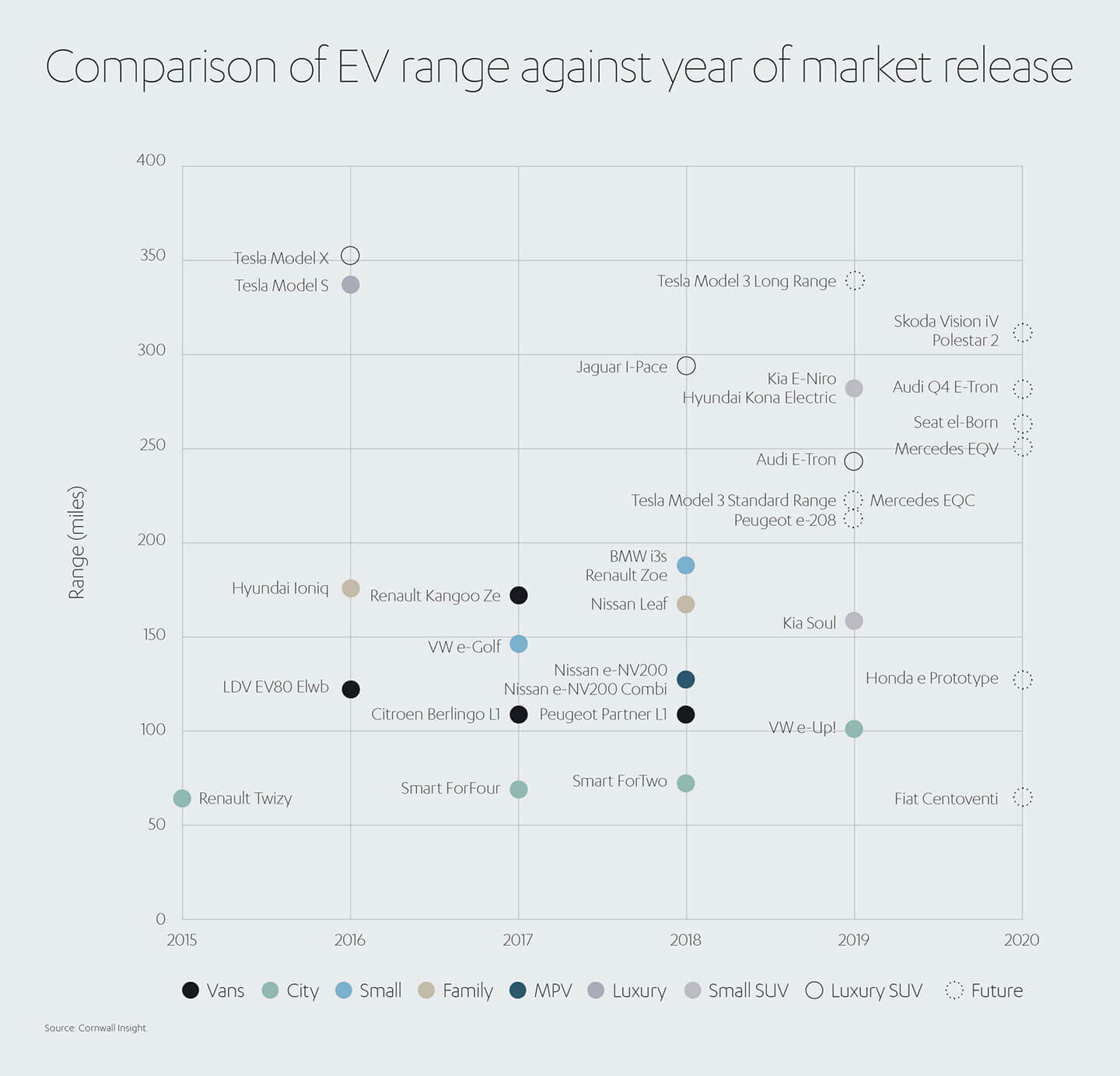

Another related concern is charging infrastructure. According to the Electric Vehicle Database[18], the average range for an EV – the distance it can travel before it needs to be charged – is currently 221 miles, with the shortest range well under 100 miles, and highest more than 400. That kind of distance is enough to cover many typical day-to-day journeys. But charging vehicles privately at home or work will not be possible for everyone. And at times, people will also want to take trips longer than their vehicle’s range. Currently, even the fastest direct current fast charging (DCFC) public charging stations take at least 20 minutes to 1 hour to charge a BEV to 80%[19]. That’s a lot of hanging around waiting for your car to charge on long journeys, not to mention the amount of space required at charging stations to accommodate more than a handful of vehicles at any one time. There is also the added complication that most existing PHEVs are incompatible with DCFC charging systems.

To support wider EV uptake, it’s essential to develop public EV fast-charging networks. But so far, the track record is not promising. BCG warns that insufficient charging infrastructure over the next few years could cause EV adoption to stall in leading markets such as the US.[20] It points to a recent survey which found that concern about a lack of public charging sites is still the leading reason for US consumers to think twice about buying an EV.

Strategic responses

To meet the US government’s target that half of all new passenger cars and light trucks sold by 2030 should be zero-emission, McKinsey estimates the country would need almost 20 times more chargers than it has now, including 1.2 million public chargers. The forecast cost of hardware, planning, and installation for this public charging infrastructure is more than US$ 35 billion.[21] The numbers are not insurmountable but delivering them will require a step-change in progress around the globe.

Similarly, McKinsey suggests that developing a robust strategy for procuring raw materials could help firms manage their costs and increase production[22]. Battery manufacturers could consider signing multi-year contracts with mining companies to supply minerals, for example, to limit the impact of fluctuating prices. And they propose that larger firms could explore investing directly in extraction and refining raw materials. Both of these trends are evident in an AP report on lithium shortages in June 2023, which said Ford had signed contracts for up to 11 years ahead with lithium suppliers on two continents. The article added that GM was investing US$ 650 million in the Canadian developer of a mine in Nevada that will provide it with enough lithium for 1 million vehicles a year.[23]

Innovating solutions

Innovations in technology and practices could play an important role in resolving some of these issues. China, for example, is developing sodium-based batteries that provide a cheaper alternative to those that use lithium. A sodium-ion battery developed in China is estimated to cost 30% less than a lithium iron phosphate battery (a type of lithium-ion battery). The IEA says almost30 plants for manufacturing sodium-ion batteries are either operating, planned or under construction – but almost all are in China.[24] Some manufacturers are reportedly planning to use sodium battery technology in EVs this year.[25]

Recycling EV batteries is another possibility. It has the potential to create US$ 95 billion a year by 2040,[26] according to experts at McKinsey. Indeed, without recycling, the firm believes batteries are likely to remain a critical bottleneck for mass electrification.

The performance of the EV battery recycling sector could therefore make or break the pace of the switch to EVs. Businesses are now racing to develop processes and capacity. In the UK, a co-founder of a startup company in the field claimed that by 2040 the car-making industry could get up to 40% of its lithium from recycling, saying “the metal you can continuously recycle almost for ever”[27].

In addition, there is growing interest in battery swapping as another solution. Just like it sounds, this is where rather than charging an EV, the user simply swaps in a different battery, with the previous one then recharged externally and later swapped into another vehicle.

The Chinese EV maker NIO has opened its first European battery swap stations, such as one in Denmark earlier this year – where the process takes about 5 minutes[28].

More recently NIO announced that it is offering a new Battery-as-a-Service product, (BaaS). The idea is that customers can purchase a new EV without a battery and then subscribe to one for a separate monthly fee. This can reduce the new-vehicle purchase price by a whopping 70,000 yuan, roughly US$ 10,100. The company says using the stations will help people who don’t have a home charger and can prolong battery life by allowing slower charging.

For trucks, the IEA says battery swapping has major advantages over ultra-fast charging in terms of speed and extending battery performance. It adds that battery swapping offers cost advantages for two and three-wheeled vehicles. This opportunity is particularly gaining momentum in India, where there are already more than 10 different companies in the market[29].

Developments like these highlight the huge potential for electric mobility to create economic and social value while reducing carbon footprints. But to navigate the real challenges ahead, businesses will need to work closely with governments to make sure appropriate policies and investment are in place to support this rapidly growing industry.

Cooling off?

In the US, at recent analyst earning calls with the big name auto-OEM, some executives also began to acknowledge that their previous and perhaps in hindsight rather ambitious EV sales forecasts may suffer some short-term cooling in consumer demand, with signs of slow-moving dealer inventory. GM were more sober about build targets of 100,000 EVs in the latter half of this year and 400,000 by June 2024. And it seems they are not alone. Recently Tesla lamented economic concerns leading to waning demand; echoed by Daimler’s Mercedes-Benz, with CFO Harald Wilhelm calling it “a pretty brutal space,” on recent analyst calls, and going in to state that he “can hardly imagine the current status quo is fully sustainable for everybody.”[30]

As inventory builds at the US retail dealer, many brands are finding it necessary to introduce incentives of up to close on 10% of list price according to Kelley Blue Book – the first time EVs have been discounted to this level in nearly five years as the acquisition price vs. ICE remains a consumer purchase barrier in hardening economic times.

Photo Credit © Honda

And this dealer experience is now being accepted by the manufacturers.

Toshihiro Mibe Chief Executive Officer of HONDA noted that the rapidly evolving EV environment was complex, announcing the scrappage of joint development plans with GM for sub-US$ 30,000 EV in an interview with Bloomberg.[31]

Photo Credit © Toyota

He was joined by Akio Toyoda Toyota Motor Corporation Chairman who has expressed some concern about many manufacturers’ ‘electric-only’ product strategies, he commented in an interview that “People are finally seeing reality,”[32][33] said at the Japan Mobility Show.

If the issues around mass adoption are able to be addressed quickly, efficiently and cost-effectively, electric mobility truly has potential to transform our lives. If not, EVs may be stuck at an amber traffic light for some time yet . . .

Either way, it seems that electrification will remain one of several new mobility technologies in the mix as we strive to net zero emissions alongside other emergent technologies such as hydrogen fuel cells, carbon-neutral fuels and more.

[1] https://www.reuters.com/business/environment/un-chief-urges-faster-shift-net-zero-after-report-highlights-climate-threat-2023-03-20/

[2] https://www.bcg.com/publications/2022/electric-cars-finding-next-gear

[3] https://u.ae/en/about-the-uae/strategies-initiatives-and-awards/policies/transport-and-infrastructure/national-electric-vehicles-policy

[4] https://www.mckinsey.com/features/mckinsey-center-for-future-mobility/our-insights/electric-vehicles-whats-ahead

[5] https://global.toyota/en/newsroom/corporate/39013233.html

[6] https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/preparing-the-world-for-zero-emission-trucks

[7] https://theicct.org/electric-buses-europe-may23/

[8] https://www.carmagazine.co.uk/car-news/tech/what-is-regenerative-braking-/

[9] https://afdc.energy.gov/vehicles/electric_basics_ev.html

[10] https://solarpower.guide/solar-energy-insights/countries-largest-shares-renewable-energy-solar

[11] https://www.nimblefins.co.uk/average-cost-electric-car-uk

[12] https://cars.usnews.com/cars-trucks/advice/why-are-electric-cars-so-expensive

[13] https://www.bcg.com/publications/2022/electric-cars-finding-next-gear

[14] https://www.washingtonpost.com/climate-environment/2023/02/07/ev-battery-power-your-home/

[15] https://www.mckinsey.com/capabilities/operations/our-insights/power-spike-how-battery-makers-can-respond-to-surging-demand-from-evs

[16] https://www.reuters.com/markets/commodities/lithium-producers-warn-global-supplies-may-not-meet-electric-vehicle-demand-2023-06-22/

[17] https://www.iea.org/reports/global-ev-outlook-2023/trends-in-batteries

[18] https://ev-database.org/cheatsheet/range-electric-car

[19] https://www.transportation.gov/rural/ev/toolkit/ev-basics/charging-speeds

[20] https://www.bcg.com/publications/2022/electric-cars-finding-next-gear

[21] https://www.mckinsey.com/industries/public-sector/our-insights/building-the-electric-vehicle-charging-infrastructure-america-needs

[22] https://www.mckinsey.com/capabilities/operations/our-insights/power-spike-how-battery-makers-can-respond-to-surging-demand-from-evs

[23] https://apnews.com/article/china-ev-lithium-united-states-battery-87eb9382a0181bb7ee64e835efe7b170

[24] https://www.iea.org/reports/global-ev-outlook-2023/trends-in-batteries

[25] https://www.electrive.com/2023/04/21/catl-and-byd-to-use-sodium-ion-batteries-in-evs-this-year/

[26] https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/battery-recycling-takes-the-drivers-seat

[27] https://www.theguardian.com/environment/2023/apr/08/shock-and-ore-uk-firms-race-to-get-in-on-electric-car-battery-recycling-act

[28] https://www.euronews.com/next/2023/04/09/tired-of-waiting-ev-charging-stations-first-nio-battery-swap-stations-open-in-europe

[29] https://www.iea.org/reports/global-ev-outlook-2023/trends-in-charging-infrastructure

[30] https://www.reuters.com/business/autos-transportation/mercedes-benz-expects-hit-lower-end-returns-forecast-cars-division-2023-10-26/

[31] https://www.bloomberg.com/news/articles/2023-10-25/honda-ceo-says-scrapping-plans-with-gm-to-develop-smaller-evs?embedded-checkout=true&sref=LspfQlRv#xj4y7vzkg

[32] https://www.wsj.com/business/autos/toyota-chairman-says-people-are-finally-seeing-the-reality-about-evs-31f1669c?mod=autos_news_article_pos1

[33] https://fortune.com/2023/10/25/toyota-chairman-akio-toyoda-electric-vehicles-ev-ford-gm-tesla-earnings-elon-musk/