Is aerial mobility ready for take-off at last?

Joby eVTOL Aircraft in flight. Photo Credit: © Joby Aviation

After years of planning, investment and innovation, the next decade should see urban aerial mobility (UAM) launching from the drawing board to city skies, flexing its wings on the world stage and truly defying economic gravity.

Old assumptions – that goods travel by road or rail, and that people use cars, trains and buses to navigate cities – are being challenged by new market entrants for whom the tag ‘up-and-coming’ is a literal mission statement.

The world’s leading eVTOL (electric Vertical Take-Off and Landing) aircraft companies are drawing ever-closer to commercialization. Many are already flying full-scale prototypes, with several surpassing key milestones in national certification programs.

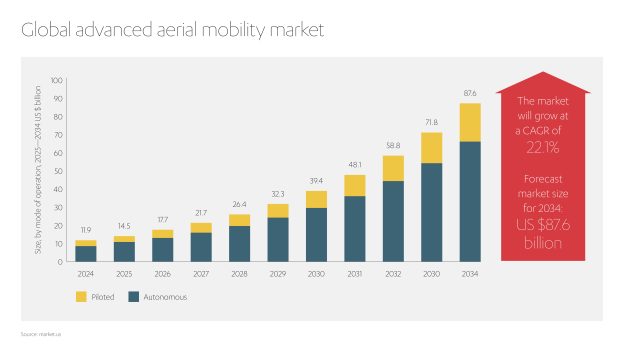

Globally, the UAM market is expected to hit US$ 14.5 billion by the end of this year, a rise of almost 20% in the space of just 12 months. These figures are indicative of a longer-term trend which will see the sector reach a potential valuation of US$ 87.6 billion by 2034 (CAGR: 22.1%).[1]

Looking further ahead, by mid-century, estimates suggest the unmanned segment alone will reach US$ 90 billion in annual revenues, with some 160,000 drones crisscrossing the skies above our heads.[2]

Examining precisely what is being flown, and where, sheds further light on an industry which barely existed as little as a decade ago.

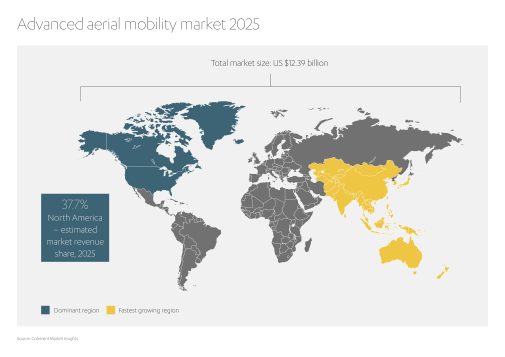

Market insights show that just over 37% of all economic activity in the UAM sector during 2025 has been based in the USA, with Asia and Oceania representing regions of fastest growth.[3]

With rampant progress in technology, legislation and certification, the last 12 months have seen a number of notable landmarks in the UAM market.

How fast is the global aerial mobility sector developing?

Globally it is up, up and away for the UAM sector, with more than 850 projects at varying stages of completion worldwide.[4]

One of the leading players in the space received early financial backing from players like Toyota and the Jameel family’s venture investments arm, JIMCO: California-based Joby Aviation. After originally investing in the aviation pioneers in 2020, in June 2025 Abdul Latif Jameel and Joby Aviation signed a further groundbreaking agreement to accelerate the distribution of urban aircraft throughout the Middle East. Under the deal, Joby Aviation will manufacture and supply up to 200 aircraft together with support services. The deal, potentially valued at US$ 1 billion, supports Saudi Arabia’s Vision 2030 program of economic and cultural diversification.[5]

Adding further momentum, the same month saw Joby Aviation successfully complete a series of piloted vertical-take-off-and-landing tests in Dubai.

The flights, a milestone in the sector, signify commercial readiness and support the company’s ambitions to carry its first paying passengers as early as 2026. Joby Aviation aircraft have now accumulated more than 40,000 hours of testing. When fully operational, a fleet of Joby eVOTL aircraft will convey Dubai residents and tourists from one location to another safely and rapidly, synching up with individual mobility options such as e-scooters and bikes for a new era of seamless multimodal travel.

Efficiency is a major advantage. The journey from Dubai International Airport to Palm Jumeirah, for example, takes 45 minutes in a car but just 12 minutes by air. It is cleaner, too. The four passengers (plus one pilot) completing the 200 mph journey in an electric Joby aircraft would generate zero fuel emissions, helping protect our precious atmosphere.[6]

In support of this, Joby Aviation began construction in November last year on the first vertiport in its planned Dubai air taxi network. The vertiport, to be located at Dubai International Airport, will be followed by three further vertiports in Palm Jumeirah, Dubai Downtown and Dubai Marina.

The UAE’s eVOTL masterplan extends far beyond Dubai, with plans for an ‘inter-emirate air corridor’ linking Dubai with Ras Al Khaimah more than 100 km to the north. The scheme – a partnership between Joby Avation, RAKTA and Skyports – could launch as soon as 2027. Vertiport locations in Ras Al Khaimah will include Al Marjan Island, a major resort currently under construction, and Jebel Jais, the UAE’s highest peak. Flying taxis could cut the current journey time from Dubai International Airport to Al Marjan Island from over an hour via road to just 15 minutes by air.

Outside the Middle East, September saw Joby Aviation captivating crowds at Japan’s Expo 2025 in Osaka with an air taxi flight demonstration. The flight, a world first at a public expo, included vertical take-off and landing manoeuvres plus a full transition to wingborne flight. The demonstrations were staged as part of Joby Aviation’s vision to build a national air taxi ecosystem in Japan alongside local aviation partner ANA Holdings, with plans for a phased rollout beginning in Tokyo.

From a legislative perspective, September saw Joby Aviation join the USA’s Electric Vertical and Landing Integration Pilot Program (eIPP). The initiative links eVOTL developers with airlines and state governments to test air taxis and cargo planes in real-world scenarios. Trials will equip regulators with crucial data on performance and safety, setting benchmarks for future certification standards.

Further afield, other international organizations are working to ensure that when the sector achieves mass adoption, laws are in place to ensure safe operation. The European Union Aviation Safety Agency (EASA), for example, is developing eVOTL-specific standards governing licensing, operational protocols and air traffic management to encourage smooth integration.

Joby Aviation is itself on the journey towards a regulatory green light in America. This year it has progressed through the fourth of five stages in the Federal Aviation Authority (FAA) Type Certification process. There are plans to commence testing with FAA pilots on board early next year.

Fellow California-based Archer Aviation is finishing internal testing of its Midnight air taxi and expects to start FAA flight accreditation next year. It is targeting commercial launch in time for the 2028 Los Angeles Olympic and Paralympic Games, where it will serve as the official air taxi provider.

In anticipation of regulatory approval, aerial mobility providers are already starting to ramp up production. Joby Aviation bosses, for example, plan to double production capacity to 24 vehicles annually across 435,000 square feet of factory in Marina, California, while also expanding manufacturing facilities at its plant in Dayton, Ohio.

The trend appears to be global. In July, Middle East UAM manufacturer AIR unveiled a new 32,000 square foot factory to accelerate production of its range of mid-sized eVOTLs. AIR has doubled its team size over the past year to help deliver 15 uncrewed cargo aircraft and to meet 2,500 pre-orders for AIR ONE, its piloted personal vehicle.[7]

Chinese autonomous aerial vehicle innovator EHang is also banking on major growth. In February 2025 it announced a new strategic partnership to build a cutting-edge manufacturing base in for its low-altitude urban aircraft.[8] The new base, to be located in Hefei, Anhui province, will establish templates for key aircraft components and help promote unified industry standards across the region.

What are the latest technology advances in the aerial mobility sector?

These advances all suggest growing economic confidence in the UAM sector – a confidence matched by the pace of technological advances.

New patents continue to be filed for innovations around cargo capacity, accessible cabin doors, and ‘wings’ composed of rotors which can be tilted to provide forward thrust – all designed to optimize weight distribution and minimize aerodynamic drag.[9]

Refinements in advanced battery and charging technology, central to the aerial mobility vision, are heralding improvements to energy density, recharge speeds and overall battery lifespans.

The worldwide patent market reflects these trends, justifying the surge in research and investment. Urban air mobility patents soared from 67 in 2014 to 379 by 2023, covering innovations ranging from easy-access luggage hatches, to energy efficiency, limited-space take-off technology, and aerodynamic drag minimization. During the 2020s these patents have been led by the USA (988 patents approved), China (607), Republic of Korea (251), Japan (202) and Germany (152), highlighting epicenters of investment and technology.[10]

Materials science continues to be a fresh source of innovation. New lithium-sulfur batteries emerging in 2024 reached energy densities of 400 watt-hours per kilogram – a marked 60% improvement over traditional lithium-ion systems.[11]

No matter the power of the battery, recharging is essential. This is the driving force behind Beta Technologies, an electric aerospace company based in Vermont, USA. Beta Technologies is developing a network of fast charging stations to support the wide rollout of eVOTL aircraft. Its charging bays at Marshfield Municipal Airport, for example, is Massachusetts’ first ever public-access aircraft charging station. Other US states – North Carolina, Alabama and Mississippi – have been inspired to follow suit with their own open-access aerial charging facilities.

The reality of UAM is entering the public consciousness globally, but regional variations are emerging in terms of readiness for adoption. So, which parts of the world truly have their eyes on the skies?

Which regions are leading the way in urban air mobility?

The Middle East has fast emerged as an exciting hub for UAM research and deployment. The UAE in particular has birthed billions of dollars of investment and fostered a number of key strategic alliances between aircraft manufacturers and public bodies such as the Dubai Roads and Transport Authority (RTA), the Abu Dhabi Department of Economic Development (ADDED) and the General Civil Aviation Authority (GCAA). With the sixth largest GDP per capita in the world, the UAE has a ready-made community of eVOTL customers-in-waiting.[12]

Coordination is key. Joby Aviation, alongside Archer, EHang and REGENT (an electric sea-glider pioneer), have all joined Abu Dhabi’s Smart Autonomous Vehicle Industry (SAVI) cluster. SAVI, a network of government-sponsored research, testing and manufacturing facilities within the city, is expected to generate AED 44 billion for Abu Dhabi’s economy and create more than 35,000 jobs.[13] This November will also see Abu Dhabi hosting its second DRIFTx exhibition, showcasing the latest technologies in autonomous transportation. The previous event attracted more than 8,000 delegates from 65 countries.

Boasting the technology hub of Silicon Valley, the United States is likewise focused on propelling the UAM market to new heights. Ambitious investments in research and development, alongside an accommodating regulatory landscape, is turbocharging growth across the region. Industry experts are predicting the sector will expand to US$ 5.8 billion market size by 2032, achieving a runaway 17.5% CAGR, driven by demand for sustainable transport solutions.[14]

Asia-Pacific, subject to rapid urban sprawl and congested roads, is set to embrace the myriad opportunities offered by aerial mobility. China, with its heavy technology focus and vibrant stock markets, will likely serve as the sector’s regional epicenter. In a key milestone, Chinese manufacturer EHang’s autonomous flying taxis this year secured licenses for commercial passenger services in cities including Guangzhou and Hefei. Rival Chinese developer Chery commenced its own certification process in October 2025. China has a national plan for the development of a ‘low-altitude economy’, enshrining government support for human transport, logistics and drones. Market size across Asia-Pacific is tipped to grow fivefold from US$ 800 million (as of 2023) to US$ 3.9 billion by 2032.[15]

Europe, with its strong focus on sustainability and reducing carbon emissions, is likewise experiencing tangible growth in UAM. In design labs and factories across the continent a wave of advanced eVOTL aircraft and drones are being developed to fulfil a range of needs, from passenger transport to cargo delivery and even emergency response. The European Commission’s Drone Strategy 2.0 aims to support drone research across the region, supported by recent U-Space regulations from the EU Aviation Safety Agency (EASA) to integrate aerial vehicles safely into European airspace. The European Union’s UAM Initiative Cities Community (UIC2) is a city-level project “to drive the sustainable and secure transition of urban mobility to the vertical dimension”.[16] Between now and 2032 the UAM market in Europe is expected to surge to US$ 4.2 billion for a robust CAGR of 18.2%.[17]

Given these trends the UAM industry’s take-off might seem assured. However, its journey is unlikely to be turbulence-free.

Where is investment coming from in the UAM sector?

Although the industry is nearing the commercial launchpad, some unexpected crosswinds are starting to emerge. Scarcer funding is impacting several companies across the UAM value chain.

Mirroring broader declines in venture capital across all industries, funding for UAM technology hovered just below the US$ 4 billion mark in 2024, a dip from its record US$ 6.8 billion in 2021.[18]

Investment matters, because development and testing to certification-level typically costs between US$ 1 billion and US$ 2 billion per model. Securing a viable supply chain is also an expensive proposition. A deep funding pool is necessary to establish vehicle fleets long before eventual profitability.

Despite these potential shortfalls confidence in the industry remains high, with order books, options, and letters-of-intent bristling with activity. Recent UAM orders are valued at around US$ 168 billion, split between approximately 35,000 separate ventures.[19]

Pre-delivery payments central to many contracts, are helping to reconcile the funding gap and bankroll developers through the costly certification process. Partnerships with legacy aerospace and automobile players are helping to plug technology shortfalls and encourage consumer confidence in unknown brands.

Manufacturers in the UAM space have little reason to panic, knowing that as the sector matures funding will migrate from speculative venture capital to traditional private equity. Institutional investors and sovereign wealth funds are likely to provide guarantees of ongoing liquidity.

Once an established pathway to certification emerges, and the industry evolves from cutting-edge to mainstream, future cash investments will be dramatically de-risked, and a new wave of funding will be unleashed.

How can we ensure aerial mobility is affordable?

While the fragile nature of human life places inherent constraints on the aerial passenger sector, the financial bounties of the more advanced drone delivery market will carry the industry as a whole.

Drone delivery services are on an unstoppable rise, with more than 800,000 commercial deliveries undertaken worldwide in 2023. This is merely the beginning, with deliveries set to double by 2035 and generate some US$ 5 billion of revenue.[20]

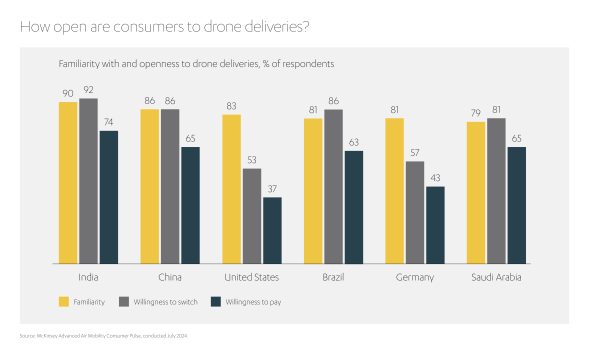

There is little doubt that people are ready, psychologically and in principle, for low-altitude traffic in our urban spaces. One wide-ranging survey from McKinsey on the concept of drone deliveries revealed that the overwhelming majority of respondents were in favor of their introduction[21]. These trends are global. Among the six major economies surveyed – the USA, China, India, Germany, Brazil and Saudi Arabia – an average of 83% of people expressed familiarity with the concept of drone deliveries, while 76% said they would be willing to use such a service, a 19% rise on the previous survey from 2021.[22]

As air taxi journeys become more routine they will become affordable for the majority, not just the fortunate elite. The journey itself may be sky high, but prices look set to remain realistic for many city-dwellers. Commercial UAM passenger services are targeting an initial price band of US$ 3 to US$ 8 per mile.[23] These prices will land in the financial sweet spot for business commuters and tourists, and will only decline further as such services become more commonplace.

Air taxis might also find support from an unlikely quarter – the environmental lobby. When considering the whole energy supply chain, eVOTL aircraft typically emit just 15% of the emissions of standard helicopters and small aircraft, handily winning the sustainability argument.[24]

Current developments in the UAM sector may be a unique pivot point in history – the before and after of urban aerial mobility. In 2025 we remain anchored at ground level, stuck in traffic queues gazing up at the empty skies; in the space of a few short years we could become low-altitude city-hoppers zipping back and forth across urban skyscapes.

Future generations, accustomed to the airborne transportation of people and cargo, may look back at the time when such technology seemed a distant dream, and in doing so wonder how we navigated our lives without it.

Engineers, urban planners and potential customers are equally excited about the aerial revolution to come. With live trials already under way, and regulators preparing legislation for widespread adoption, cargo and passenger drones could become the latest jigsaw piece in the grand vision of AI-driven smart cities. After a period in the doldrums, perhaps the global economy is ready to fly high once more.

[1] https://market.us/report/advanced-aerial-mobility-market/

[2] https://www.rolandberger.com/en/Insights/Global-Topics/Urban-Air-Mobility/

[3] https://www.coherentmarketinsights.com/industry-reports/advanced-aerial-mobility-market

[4] https://www.intertraffic.com/news/urban-mobility/urban-aerial-mobility

[5] https://www.jobyaviation.com/news/abdul-latif-jameel-and-joby-agree-to-explore-opportunities/

[6] https://www.jobyaviation.com/news/joby-cements-global-lead-in-air-taxi-industry/

[7] https://evtolinsights.com/air-unveils-new-production-facility-to-accelerate-evtol-deliveries-in-response-to-growing-demand/

[8] https://www.compositesworld.com/news/ehang-and-partners-to-build-evtol-manufacturing-base-in-china

[9] https://www.wipo.int/web-publications/wipo-technology-trends-technical-annex-the-future-of-transportation-in-the-air/en/emerging-technology-in-detail-urban-air-mobility.html

[10] https://www.wipo.int/web-publications/wipo-technology-trends-technical-annex-the-future-of-transportation-in-the-air/en/emerging-technology-in-detail-urban-air-mobility.html

[11] https://www.privatecharterx.blog/urban-air-mobility-market-2025-analysis/

[12] https://www.flyingmag.com/the-middle-east-cradle-of-urban-air-mobility/

[13] https://www.zawya.com/en/press-release/events-and-conferences/adio-to-host-driftx-2025-as-the-global-platform-for-smart-and-autonomous-mobility-e4mn895d

[14] https://dataintelo.com/report/advanced-aerial-mobility-market

[15] https://dataintelo.com/report/advanced-aerial-mobility-market

[16] https://civitas.eu/urban-air-mobility

[17] https://dataintelo.com/report/advanced-aerial-mobility-market

[18] https://www.mckinsey.com/industries/aerospace-and-defense/our-insights/future-air-mobility-blog/bridging-the-gap-how-future-air-mobility-can-adapt-to-decreased-funding

[19] https://www.mckinsey.com/industries/aerospace-and-defense/our-insights/future-air-mobility-blog/bridging-the-gap-how-future-air-mobility-can-adapt-to-decreased-funding

[20] https://www.mckinsey.com/industries/aerospace-and-defense/our-insights/future-air-mobility-blog/consumer-views-of-drone-delivery-how-soon-can-you-get-here

[21] https://www.mckinsey.com/industries/aerospace-and-defense/our-insights/future-air-mobility-blog/consumer-views-of-drone-delivery-how-soon-can-you-get-here

[22] https://www.mckinsey.com/industries/aerospace-and-defense/our-insights/future-air-mobility-blog/consumer-views-of-drone-delivery-how-soon-can-you-get-here

[23] https://www.privatecharterx.blog/urban-air-mobility-market-2025-analysis/

[24] https://www.privatecharterx.blog/urban-air-mobility-market-2025-analysis/