Exploring India’s EV transition

India’s electric vehicle (EV) market is at a fork in the road. Sales trends suggest that EV adoption is now accelerating with enviable speed – depending on the number of wheels involved.

Globally, EV sales remain concentrated on a handful of core markets. In car terms, 2023 saw almost 60% of new EV registrations in China, around 25% in Europe and 10% in the United States – leaving the rest of the world to share the remaining 5% of global sales.[1]

What does this look like, in volume terms, for India? In 2023, just 2% of all new cars sold were electric, a fraction of the worldwide average of 18%. That might not sound too exciting, but to put it in context, electric car registrations in India actually grew 70% year-on-year in 2023 to a record 80,000.[2] In the first quarter of 2024, sales of EVs in India spiked a further 50%, with the rest of the year expected to follow suit.[3]

It’s also crucial to remember that not all electric mobility options come on four wheels – especially in India. The market for two- and three-wheelers, with their lower purchase costs and ability to nimbly navigate congested streets, is substantially stronger.

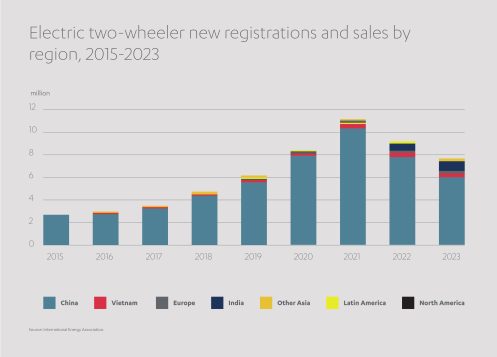

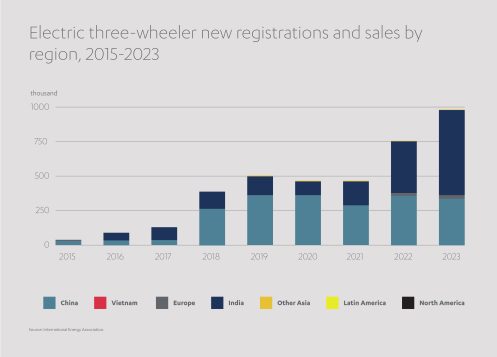

Notably, 2023 saw India supplant China for the first time as the world’s largest global electric three-wheeler market, its 580,000 new sales marking a 65% uptick in the space of a year.[4] In two-wheeler terms India remains second only to China, with sales growing 40% in 2023, led by domestic manufacturers like Ola Electric, TVS Motor, Ather, Bajaj and Greaves Electric Mobility.[5]

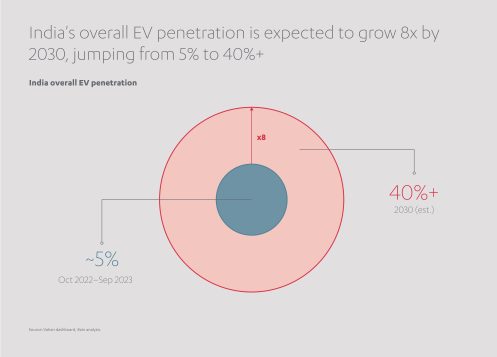

Electric motorbikes and trikes, which together comprise up to 90% of the country’s overall EV presence, are expected to surge a further 45% between now and 2030. This will drive overall EV penetration in India as high as 40% by the end of the decade, eight times its current figure.[6] Such growth could unlock potential EV revenue of around US$ 100 billion in India by 2030.

Domestic manufacturers are capitalizing on this surging market thanks to steep import duties for imported new EVs, a prohibition on foreign used vehicles, and most importantly a supportive policy environment.

Are legislators plugged in to potential of EV sector?

Indian legislators have strived to encourage wider EV or hybrid adoption via a range of supportive strategies, including:

- The Faster Adoption and Manufacturing of Electric Vehicles (FAME) subsidy scheme

- Supply-side incentives under the Production Linked Incentive (PLI) scheme

- Tax benefits

- The Go Electric campaign

Some of these complementary initiatives are worth exploring in more detail.

What is FAME?

FAME, the initial two phases running from April 2015 to March 2024, aimed to boost EV sales by making purchases more affordable, and by supporting the development of cutting-edge battery technology. Phase one addressed a broad category of vehicles, from autorickshaws to buses and everything in between. Phase two focused primarily on electric two- and three-wheelers, and is widely credited with the sales surge witnessed in these categories over the past few years. Phase two promised a subsidy of Rs 20,000 (around US$ 230) per vehicle purchase, alongside a government commitment to install 2,700 charging points across the country.

Together, these two measures proved vital for bringing prices into closer alignment with ICE equivalents, and for soothing motorists’ so-called ‘range anxiety’. During FAME-I around 278,000 EVs qualified for incentives of almost US$ 40 million. Under FAME-II, more than 870,000 vehicles attracted similar subsidies. These uptake figures mark a sharp contrast with 2014, the year preceding FAME’s launch, when just 480 EVs were sold during the whole twelve-month period.[7]

To bridge the gap until the widely-expected FAME-III, legislators have embarked on a series of interim measures – an Electric Mobility Promotion Scheme (EMPS) and PM E-DRIVE fund – to continue subsidizing electric two- and three-wheeler purchases.

What is the PLI scheme?

The Indian government has been equally proactive in its Production-Linked Incentives (PLI) scheme. Under PLI rules, automakers and component manufacturers specializing in EV technology can apply for a share of a US$ 3.6 billion government support fund. The initiative has generated 2.5 times that amount in private investment, and its original 2027 deadline has been extended a further 12 months.[8]

The PLI featured a second tranche of support, ringfenced for evolutions in battery storage technology, via 2021’s five-year Advanced Chemistry Cell (ACC) scheme. [9] The US$ 2.5 billion fund is helping to bankroll the development of giga-scale battery plants in India, ultimately establishing some 50 GWh of ACC production capacity to underpin the country’s domestic EV industry.[10] Three manufacturers have so far made winning bids for a slice of the fund and have unveiled their plans for lithium-ion battery gigafactories.

What is the Go Electric initative?

The nationwide Go Electric campaign was launched by the Ministry of Power and Ministry of Road Transport and Highways in February 2021. More public-facing than the other strategies discussed, it funds advertising campaigns to raise awareness of the benefits of electric mobility and to inspire confidence in the ever-growing EV charging infrastructure.[11] Go Electric aims not only to secure a lower-carbon economy, but also to reduce the country’s current import dependence.[12]

Any such initiatives though, can only succeed with the widespread backing of motorists. Fortunately, consumers may be about to speak with their wallets.

Buyer intentions point to EV industry’s bright future

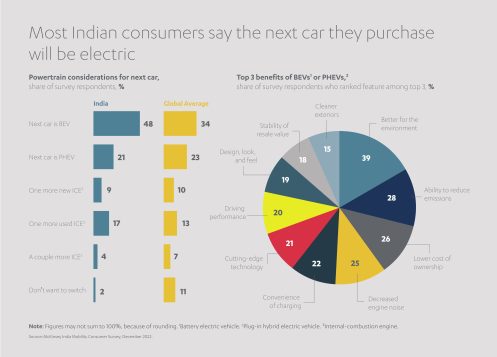

Industry experts declare the Indian EV sector is potentially approaching an ‘inflection point’.[13] A 2024 survey indicated that seven-in-ten motorists in India, when quizzed about their next vehicle purchase, said they intended to opt for a full battery EV or a plug-in hybrid. This figure (split between 49% backing BEVs and 21% leaning towards hybrids) actually surpasses the EV intentions of the rest of the world, where a global average of 57% of consumers expect their next vehicle to be green. Only 2% of motorists in India do not want to switch away from internal combustion engines (ICE) at all, considerably fewer than the 11% of holdouts recorded globally.[14]

A hot, dry country, India is at the forefront of the battle against climate change. Severe floods and deadly heatwaves are already occurring with ominous frequency.[15] It is perhaps unsurprising, therefore, that protecting the environment by reducing emissions was one of the key reasons cited by potential buyers for their shift to EVs. Only safety, the power of brands and purchase price/cost of ownership exceeded emissions as motivating factors.[16]

How best to unlock this pent-up demand? First and foremost, by listening to the customer. Despite recent advances in charging infrastructure, more than three-quarters of motorists in India still feel the country has an insufficient network of charge points.[17] Investing in both public and home charging facilities will therefore prove pivotal for large-scale EV adoption.

A more comprehensive servicing ecosystem will help nurture faith in the technology, as will a robust plan for rolling out mass test-drives. Surveys show that extended test-drives of at least seven-to-ten days proved decisive for 24% of wavering EV customers.

In India, as in other emerging market and developing economies (EMDEs), the comparatively high price of EVs is deterring some customers. Tata’s small Tiago and Tigor cars captured one-fifth of India’s EV market in 2023. However, at US$ 10,000 to US$ 15,000 per unit, they cost up to twice as much as the average small ICE equivalent, typically costing US$ 7,000.[18]

In a fast-changing consumer market, incorporating the latest features and technologies is also important. Motorists in India are hearing about evolutions in EV technology in mature economies – things like voice recognition, telematics, regenerative braking, user-adapted algorithms, remote diagnostics and mobile apps for charging on the go – and they want to share in those benefits too.

Some ambitious EV startups are taking the fight to established marques like Tata and Mahindra by merging cutting-edge technology with affordability, empowering whole new market segments to live out their EV dreams.

How is Abdul Latif Jameel a partner in India’s electric mobility revolution?

Greaves Electric Motors (GEM), Abdul Latif Jameel’s sustainable mobility partner in India, is one of the key players thriving in India’s EV boom. GEM, backed by a 165-year engineering legacy, focuses on affordable and sustainable scooters, motorcycles and three-wheelers manufactured at sites across Tamil Nadu, Telangana and Uttar Pradesh. Key brands include Ampere, one of India’s leading e-scooters, and Ele, an auto-rickshaw with a five-battery capacity and drive range of up to 150 kilometers.

Abdul Latif Jameel’s 2022 investment in GEM was motivated in part by the companies’ similar evolution and ethos. Both longstanding family businesses, Greaves also made its reputation with traditional powertrain vehicles before turning its attention to sustainable motoring. Its early-mover advantage saw it achieve sizable market share across both B2B and B2C customer bases. At the 2023 India Auto Expo, GEM previewed no less than six new two- and three-wheelers to capitalize on market buoyancy.

Abdul Latif Jameel’s backing for GEM aims to support the manufacturer to expand its portfolio to other markets across the Global South – a proposition which is already bearing fruit. Greaves recently confirmed its maiden foray into the global market with the opening of its first showroom in Nepal, in partnership with the Kedia Organization, a major Nepalese business conglomerate. Kedia will serve as the exclusive distributor for sales, marketing, distribution, and after-sales support of Ampere two-wheelers in Nepal. Multiple outlets and dealerships are expected to follow nationwide.

GEM boasts a diverse product portfolio, also featuring the electric cargo three-wheeler Eltra and its passenger variant the Eltra City. Last year the Eltra City secured its reputation as India’s longest-range three-wheeler with a record setting 225-kilometer trip from Bangalore to Mysore on a single charge.[19]

Action plan to electrify sustainable motoring in India

GEM, while doubtless in the ascendancy, is subject to the same pressures and market forces as every other player in the EV business. To ensure a permanent transition to sustainable transport, how can governments and corporations seize the initiative and intervene most effectively in this burgeoning sector?

The most effective strategies to encourage further uptake of EVs in India will focus on price, technology and support infrastructure. But what precisely does this entail, beyond these ambiguous aspirations?

- Cost: EV prices must fall to match the lower initial outlay of ICE equivalents popular in India and manufactured by industry titans such as Honda. Counterintuitively, this could entail a measured reduction in quality and a curtailing of optional features. Manufacturers, particularly tech-savvy disruptors, would benefit from a better understanding of customer expectations regarding issues such as range and performance.

- Distribution: EVs in India are making most inroads in megacities: Delhi, Mumbai, Chennai, Kolkata and Hyderabad. EV manufacturers and legislators must devise ways to expand beyond these core markets by increasing the number of EV outlets in second-tier cities and educating customers about their long-term economic and environmental benefits. New strategies, such as direct-to-customer sales, might be needed to supplement the traditional dealer model with its inherent high overheads.

- B2B momentum: Businesses are less concerned than private individuals about high EV purchase costs – they are more interested in lower Total Cost of Ownership (TCO) over the lifespan of a vehicle. To illustrate, Amazon is adding 10,000 EVs to its Indian logistics fleet by 2025, and Uber 25,000 by the year after.[20] It is B2B customers, with their large fleet contracts, who can become trendsetters and help ignite the cultural shift to EVs – but only if manufacturers target them aggressively and tailor their offering around the segment’s specific needs.

- Charging: Early buyers of EVs in India are not exactly being rewarded for their progressive stance. India’s relatively unsophisticated charging infrastructure means there is one commercial charge point for every 200 EVs; in the USA, the ratio is one charge point per 20 EVs.[21] India needs a new wave of charge points, perhaps funded by public-private partnerships. It also needs to build battery-swapping facilities to encourage the purchase of EVs as light cargo vehicles.

By far the most effective strategies will address the underlying issue preventing faster EV adoption – the lack of ready finance. At present, potential EV buyers in India face a number of pressures when looking to fund such a big-ticket purchase: Limited supply of finance, high interest rates, short repayment schedules and low loan-to-value ratios. This is not entirely the fault of lenders, who are finding themselves facing risks familiar to all ‘young’ industries. They do not yet have the data, for example, allowing them to calculate the impact of battery degradation on overall asset value; nor are there enough specialist mechanics in place to meet the servicing needs of this relatively nascent sector. To really make a difference to the EV penetration of India – to turn a niche item into a logical choice – is likely to require several robust steps[22]:

- Direct public funding: Initiatives such as vehicle discount schemes, interest rate subsidies and tax rebates (for example, rebates per journey or per delivery undertaken by EV). Challenges include high upfront costs, lack of liquidity and stagnant government policy.

- Debt mobilization: Strategies could include a cash-pot to offset potential losses from loan defaults, or mass public-private partnership (PPP) tenders for charging networks. Challenges again include a lack of liquidity, plus a high risk of asset depreciation, and a shallow evidence pool for the second-hand market.

- Equity and debt investment: Encouraging new private capital into the EV value chain to bankroll technical development and broaden sales, without draining already overstretched government budgets. Development Finance Institutions such as the International Finance Corporation (IFC) can deploy debt and equity products to de-risk the industry for ambitious startups.

India, in line with many developing economies, can be a tough environment for ordinary families to secure credit. Typically, this is due to higher interest rates and a scarcity of affordable capital. Any measures that can help nurture a more active financing ecosystem would naturally spur more rapid EV adoption.

Money worries, however, are not the only factor putting the brakes on India’s EV evolution.

Why is India on the frontline of the global EV transition?

Despite good intentions, India’s pro-EV initiatives might not turn out to be as game-changing as their advocates intended. Critics of the Advanced Chemistry Cell scheme, designed to conceive the next generation of EV batteries, fear developers might run into problems familiar to such enterprises around the world. They cite a lack of technological experience among the domestic workforce, and over-reliance on a global supply chain where demand for rare Earth minerals like lithium and cobalt outstrips supply.

FAME, notwithstanding its successes, arguably failed to provide any financial support for the all-important R&D sector, tethering manufacturers to outdated technology. Nor did it do enough to address cheaper purchase prices of fossil fuel vehicles. Looking ahead, if the forthcoming FAME-III scheme reduces subsidies for EVs, as has been mooted, growth trajectories could level off. This will delay the point at which EV cars transition from ‘novelty’ to ‘the new norm’.

Few imagine that India’s EV journey will be derailed entirely, however. The country’s transport system presently consumes around 94 million tons of oil and petrol annually, an amount expected to double by 2030, and much of that raw material needs to be imported.[23] India’s fossil fuel import bill, currently exceeding US$ 100 billion per year, will need reducing to underscore its status as an independent nation – and one day, perhaps, as an economic superpower in its own right.

India is also on the frontline of the battle against climate change. With temperature extremes causing more climate catastrophes around the world, vulnerable countries such as India should be spurred into action. If greening the mobility sector can help reduce global temperature rises, India might prove less susceptible to the kind of ‘wet bulb’ heatwaves which left several hundred citizens dead in May 2023, or the smog now regularly engulfing Delhi even outside of traditional ‘smog season’.

These imperatives inspire confidence that India, for so long one of the world’s most active polluters, could build on its vibrant two-and three-wheeler market to help steer the planet towards a more sustainable future.

[1] https://www.iea.org/reports/global-ev-outlook-2024/trends-in-electric-cars

[2] https://www.iea.org/reports/global-ev-outlook-2024/trends-in-electric-cars

[3] https://www.iea.org/reports/global-ev-outlook-2024/trends-in-electric-cars

[4] https://www.iea.org/reports/global-ev-outlook-2024/trends-in-other-light-duty-electric-vehicles#abstract

[5] https://www.iea.org/reports/global-ev-outlook-2024/trends-in-other-light-duty-electric-vehicles#abstract

[6] https://www.bain.com/insights/india-electric-vehicle-report-2023/

[7] https://chambers.com/articles/evaluating-fame-ii-insights-and-road-ahead

[8] https://timesofindia.indiatimes.com/auto/news/govt-to-extend-rs-26000-crore-auto-incentive-scheme-by-a-year/articleshow/103186163.cms

[9] https://heavyindustries.gov.in/pli-scheme-national-programme-advanced-chemistry-cell-acc-battery-storage

[10] https://www.infolink-group.com/energy-article/energy-storage-topic-analysis-indias-production-linked-incentive-advanced-chemical-battery-manufactu

[11] https://www.iea.org/policies/12951-go-electric-campaign

[12] https://www.drishtiias.com/pdf/1616134161-go-electric-campaign.pdf

[13] https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/consumers-are-driving-the-transition-to-electric-cars-in-india

[14] https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/consumers-are-driving-the-transition-to-electric-cars-in-india

[15] https://wmo.int/news/media-centre/climate-change-and-extreme-weather-impacts-hit-asia-hard

[16] https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/consumers-are-driving-the-transition-to-electric-cars-in-india

[17] https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/consumers-are-driving-the-transition-to-electric-cars-in-india

[18] https://www.iea.org/reports/global-ev-outlook-2024/trends-in-electric-cars

[19] https://greaveselectricmobility.com/press-release/greaves-eltra-city-travels-225km-on-a-single-charge-becomes-the-highest-range-3-wheeler-in-india

[20] https://www.bain.com/insights/india-electric-vehicle-report-2023/

[21] https://www.bain.com/insights/india-electric-vehicle-report-2023/

[22] https://documents1.worldbank.org/curated/en/099651206172224743/pdf/IDU02131336d03f5c04f11093bd095d144caa38f.pdf

[23] https://www.drishtiias.com/pdf/1616134161-go-electric-campaign.pdf